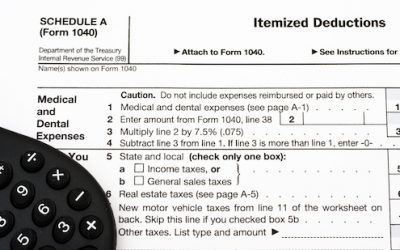

Now’s the time to start thinking about “bunching” — miscellaneous itemized deductions, that is

|Comments are Off

Many expenses that may qualify as miscellaneous itemized deductions are deductible only to the extent they exceed, in aggregate, 2% of your adjusted gross income (AGI). Bunching these expenses into a single year may allow you to exceed this “floor.” So now is a good time to add...